Payday Loans / Personal Loans - For all your everyday needs.

You can get Instant e-Transfer payday loans in Canada for up to $1500 in as little as 5 minutes! Get an instant lending decision as soon as you submit your application

Payday Loans Canada

Need cash in a hurry for unexpected expenses in your daily life? It does not matter how much loan amount you require. PaydayCity is here to assist you with instant Payday Loans up to $5,000 without any credit. PaydayCity offers borrowers the ability to get approved for a same-day between $255 to $1500 e-transfer loans today from direct lenders anywhere in Canada. Apply for guaranteed payday loans Canada instant approval 24/7 online and no matter what you're past bad credit scores. Trusted lender in Canada, apply online anytime 24/7, all types of income accepted (Employment income, but also EI, child tax, personal disability, workers' comp, and pension), no credit refused, instant interac e-transfers, 100% transparency.

What Is A Payday Loan?

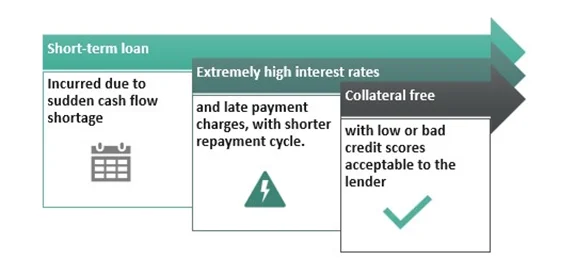

Payday loans provide short term cash against your upcoming paycheck to help you access cash when you need it the most. Payday loan direct lenders typically provide short term cash based on the payments you make in the capacity of the payday period. We limit the loan amount to a limit that the borrower is able to repay the loan installments without stress. This means that there is no worry of your loan request being rejected by the lenders for being too high. Payday loans may be available through storefront direct payday lenders in Canada or 100% online, depending on the law in your state.

How Payday Loans Do Works?

To apply for a payday loan instant approval, follow these simple steps.

Step 1 - Gather Required Document

During your online loan application process, you will be required to submit the following documents for payday loans direct lender.

- National accepted ID proof.

- Payslip lasted for 3 months.

- Electronic Bank Statement.

- Details related to your banking account.

Step 2 – Fill-Out The Application Form

Payday loans 100% online guaranteed approval from direct lenders operates a simple or fast online application process. Because 24/7 online application is more convenient and faster for the borrower than other traditional lenders. You can go through the paydaycity.ca online application process from a direct lender in Canada. Fill the loan application form with all the required information as possible. But the most important part of online loan request is the accuracy of proof of your documents as any wrong information can lead to delay in loan process. Once the form is filled, submit it for review.

Step 3 - Application Review

On receipt of your completed application form, the lender reviews your loan request after reviewing all the required documents and information from you. The lender will decide whether to approve or decline your loan.

Step 4 - Loan Disbursement

Once your loan is approved, the lender disburses the loan amount to your active bank account on the same day. Get up to $1500. 5 minutes e-transfer. Open 24/7. 100% online. Easy application. Bad credit accepted. Low-rates. Apply now.

What Is The Highest Amount You Can Loan From Direct Lenders?

| Province | Maximum Borrowing Amount | Maximum Cost Per $100 Borrowed |

|---|---|---|

| Ontario | $1,500 (up to 50% of borrower's paycheque) | $15 |

| British Columbia | $1,500 (up to 50% of borrower's paycheque) | $15 |

| Alberta | $1,500 | $15 |

| New Brunswick | $1,500 (up to 30% of borrower's paycheque) | $15 |

| P.E.I | $1,500 | $15 |

| Manitoba | $1,500 (up to 30% of borrower's paycheque) | $17 |

| Saskatchewan | $1,500 (up to 50% of borrower's paycheque) | $17 |

| Nova Scotia | $1,500 | $17 |

| Newfoundland And Labrador | $1,500 (up to 50% of borrower's paycheque) | $14 |

| Northwest Territories | $1,500 | $60 |

| Nunavut | $1,500 | $60 |

| Yukon | $1,500 | $60 |

Note: Quebec has a 35% AIR limit on all payday loans.

Why Choice A Payday Loan?

- Fast Online Application Process

- Quick Loan Payout

- Paperless Application

- 1-Click Payout

- No credit refused

- Transparent Fee Structure

- Flexible Automatic Repayments

- Multiple lenders options

What Can A Payday Loan Be Used For?

Here are some examples of what you can use online payday loans no credit check instant approval Canada for. You basically have complete freedom as to how you can use your loan.

- Car Repairs

- Medical expenses

- Rental bond

- Furniture or white goods

- Unexpected emergency

- Vet bills

- Home renovations

- Travel loans

- Dental costs

Types of Payday Loans:

Payday City currently offers a variety of loan types from direct lenders in Canada, such as:

E-Transfer Payday Loans

E-Transfer Payday Loans

Apply for Instant Payday Loans Canada from $255 - $1500. Fast decision. No credit refused. No faxing. You could receive your instant loan amount in as little as 15 minutes.

Loans For Unemployed

Loans For Unemployed

Get loans for unemployed Canada Up To $1500 with Online 24/7. Unemployment Insurance Benefits (EI). 100% Instant Approval. Same day payout via E-Transfers. Apply for loans for unemployed in just a few clicks.

Instant Cash Loans

Instant Cash Loans

Instant cash loans Canada provides easy approval up to $1500 to applicants with bad credit in only 5 minutes. Same day cash deposit via e-transfer. Almost no credit check. Apply for instant cash loans no employment verification in Canada.

Same Day Loans

Same Day Loans

Same day loans with instant approval up to $1500. 5 minutes e-transfer. Fast and convenient way to access the funds. Bad credit accepted. Zero discrimination. No matter your credit scores. Apply now.

No Broker Loans

No Broker Loans

Need a secured loan with no broker? Apply for payday loans with no broker. Friendly expert advice. Flexible repayment terms. Poor or adverse credit no problem. No Hidden Costs

Direct Lender Loans

Direct Lender Loans

Are you looking for payday loans with instant approval from direct lender in Canada? Awesome best interest rates. Transparent and simple repaying terms. Apply online now!

Pensioners Loans

Pensioners Loans

Need low income loans for pensioners? Yes' Get cash loans for pensioners in Canada. Payday City helps Canadian people on government subsidies. Apply for loans today using your CPP, OAS or other type of pension as long as it's recurring.

Cash Advance

Cash Advance

Get fast Cash Advance loans from $50 to $5,000 online from direct lenders in Canada. Same day approval. Instant funding in minutes via e-transfer. Anytime, anywhere in Canada.

Cash Loans

Cash Loans

Need cash now? Apply for cash now loans with no credit check Canada. 24/7 Open. Up to $5,000 via e-transfer. Always same day deposit. Paperless process. No credit check & All credit accepted!

High Acceptance Rate Loans

High Acceptance Rate Loans

Get payday loans with 100% acceptance rate from direct lenders in Canada? Apply now from direct lenders anywhere or anyplace in Canada and get a quick decision on loan acceptance.

Bad Credit Loans

Bad Credit Loans

Get second chance and access up to $3000 with bad credit from direct lenders. Low rates. Approvals in minutes. Trusted by thousands of Canadians. Apply online now.

Loans With No Credit Check

Loans With No Credit Check

Worried about your bad credit score preventing you from availing loan? Payday City provide online loans with no credit check instant approval Canada to help you. No credit check loans Canada up to $1500 ✓ 5 Minute Approval ✓ No FAX (Faxless) ✓ Bad Credit OK ✓ Instant Cash Advance ✓ 24/7 Interac E-Transfer.

Loans With Instant Approval

Loans With Instant Approval

Need cash fast? Get a payday loans no credit check instant approval 24/7 Canada from $255 to $1500 online here! Bad credit history OK. No worries. 5 Minute Approval. No FAX (Faxless). Apply today.

Payday Loans That Accept Such Benefits

Payday loans that accept such benefits as a source of income. We specialize in providing instant payday loans 100% online approval to Canadians on a certain government benefit income.

- Child Tax Credit Benefits

- Disability Tax Credit Benefits

- Employment Income [EI]

- Canada Recovery Benefit (CRB)

- Unemployment Insurance Benefits

- Ontario Disability Support Program (ODSP)

- Private Pension & Canada Pension Plan (CPP)

- Workers Compensation Board benefits (WCB)

- Welfare Recipients (Social Assistance)

No Hidden Fees Or Charges

PaydayCity know the importance of being honest and forthright with our rates. It's all here.

| Loan Amount | $255 to $1500 |

| Loan Type | Unsecured loans |

| Loan Term | 3 to 24 months |

| Loan Rate | 48% p.a. |

| Repayment Options | Weekly, Fortnightly, Monthly |

| Establishment Fee | $370 - 4% of the loan amount as "Monthly Fee". |

| Other Fees That May Apply | Payday lenders charge 20% of the loan amount borrowed as "Setup Fee" |

| Timings | Payday City offers 24/7 online loan approval ranging from $50 to $1500 with flexible repayment plans with same day cash deposit into your bank account. |

Pros and Cons of Payday Loans

Pros

- Fast loan processing

- Easy approval

- Minimal eligibility requirements

- Option for people with bad credit

- Accessible in an emergency

- Flexible repayment options

Cons

- Higher interest rates

- More expensive

- Short repayment period

- Predatory lenders

- Potential to get stuck in debt cycle

Why You Should Avoid Payday Loans?

Think once before taking a loan; definitely know about the financial loss of Payday Loan.

- Payday loans are very expensive –

- Payday loans are a financial quicksand –

- Borrowing from short term lenders is very easy –

- Some Payday lenders want the right to access your bank account –

- Payday lenders can be ruthless debt collectors –

Examples of the costs of your payday loan By Province

The APR and interest rates for these types of loans in Canada are quite high and you can take a look at some of the following tables to better understand it.

| Province | Max cost per $100 borrowed | Max Penalty for Returned Cheque | Cooling Off Period | Loan Rollover or Extension |

|---|---|---|---|---|

| Ontario | $15 | n/a | 2 business days | Not allowed |

| British Columbia | $15 | $20 | 2 business days | Not allowed |

| Alberta | $15 | $25 | 2 business days | Not allowed |

| New Brunswick | $15 | $20 | 48 hours (not including Sundays and holidays) | Not allowed |

| Manitoba | $17 | $20 | 48 hours (not including Sundays and holidays) | Allowed |

| Saskatchewan | $17 | $25 | Next business day | Not allowed |

| Nova Scotia | $17 | $40 (default penalty) | Next business day (or 2 days for online payday lenders) | Not allowed |

| Newfoundland and Labrador | $14 | $20 | 2 business days | Allowed |

| Prince Edward Island | $15 | n/a | 2 business days | Allowed |

| Quebec | 35% AIR | n/a | 10 days | Not allowed |

Can My Payday Loans Be Declined?

Get cash when you need it with same day instant approval. No refusal instant loans in Canada are the right answer to your short term financial problems. You can get instant payday loans Canada with guaranteed approval without worrying about your request getting rejected. No matter where you are located in Canada, Payday City offers flexible cash solutions for all your short term emergencies.

Payday Loans Frequently Asked Questions

Have a question? Find answers here with us.

Does Payday Loan Require Credit Score Check?

There are some lenders who follow the common practice of checking the past credit background of the borrowers before sanctioning the loan. Under normal circumstances, there is no need to go under a cumbersome credit check and get instant approval based on your repayment capacity.

Is There Any Requirement Of Security Against Payday Loan?

No, this is not the case for offering anything as security or collateral. You can very well understand the fact that the loan is offered only for 2 weeks.

What Will Be Consequences Of Not Repaying The Loan?

If you fail to repay the loan, you will only have to pay higher interest rate and late payment charges.

PaydayCity Lend Across! {Canada}

We Provide Guaranteed Payday Loans Online Anytime 24/7 Among Others In The Following Provinces: